florida estate tax exemption 2021

Income over 445850501600 married. The gift tax annual exclusion remained the same between 2019 and 2021.

Docreviewers Earn More Money Estate Planning How To Plan

Individuals and families must pay the following capital gains taxes.

. 2022 EstateGiftGST Exemption - increased to 1206 million from 117 million. Citizen Spouse - increased to 164000. Income over 40400 single80800 married.

Florida estate tax exemption 2021. Starting in 2022 the exclusion amount will increase annually based on. In 2021 the annual gift tax exemption is 15000 meaning a person can give up 15000 to as many people as they want without having to pay any taxes on the gifts.

This exemption is up from 159000 in 2021. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. 3 Oversee property tax.

Federal Estate Tax. Application by March 1 of the tax year shall constitute a waiver of the exemption privilege for that year. Citizen may exempt this amount from estate taxation on assets in their taxable estate.

The added 25000 applies to assessed value over. Alternative Minimum Tax AMT In 2021 AMT exemption amounts increase to 73600 for individuals up from 72900 in 2020 and 114600 for married couples filing jointly up from 113400 in 2020. Except as otherwise expressly provided in this act this act shall take effect July 1 2021 Last Action.

Also the phaseout threshold increases to 523600 1047200 for married filing jointly. Still individuals living in Florida are subject to the Federal gift tax rules. Extending the expiration date of the sales tax exemption for data center property.

As the table below shows the first 1 million is. Ncome up to 40400 single80800 married. The estate tax exemption in 2021 is 11500000.

What this means is that estates worth less than 117 million wont pay any federal estate taxes at all. Florida estate tax exemption 2021. If youre a Florida resident and the total value of your estate is less than 114 million you will pay neither state nor federal estate taxes.

Citizen or domiciliary is subject to US. However for estates that do the federal tax bill is can be taxed at a 40 rate. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Cesky krumlov from prague. Every person who has legal or equitable title to real. The District of Columbia moved in the opposite direction lowering its estate tax exemption from 58 million to 4 million in 2021 but simultaneously dropping its bottom rate from 12 to 112 percent.

2022 Annual Exclusion Gift to non-US. The Department reviews each exemption certificate sixty 60 days before the current certificate expires. There is no gift tax in Florida.

Laws of Florida are exempt from the taxes authorized by subsection 1. As a result of recent tax law changes only those who die in 2019 with estates equal to or greater than 114 million must pay the federal estate tax. The 2021 exemption amount will be 117 million up from 1158 million for 2020.

The Florida real estate homestead tax exemption is by far the most popular and common way to reduce your property tax bill. Estate tax on the fair market value of all assets owned wherever situated at date of death. Also the other potential discounts are all for Floridians with this initial homestead exemption.

You will be asked for a Florida. The estate tax exemption in 2021 is 11700000. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. For 2021 the estate of a US. Just a small percentage of Americans die with an estate worth 117 million or more.

Sales tax exemption certificates expire after five years. Most Realtors know about the 50000 standard homestead exemption but did you know that there are around two dozen other exemptions. Citizen or domiciliary decedent is allowed an exemption of 11700000 before the imposition of estate tax.

Property in the State of Florida and who resides thereon. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The tax cuts and jobs act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Lets not forget my favorite annual amount announcement - for calendar year 2022 the tax imposed under 4161 b 2 A on the first sale by the manufacturer producer or importer of any shaft of a type used in. Florida used to have a gift tax but it was repealed in 2004.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. But once you begin providing gifts worth more than the applicable annual limit to any individual in a.

For those governmental entities located outside Florida. Note that under current law the increases in exemption amounts that began in 2018 are set to expire in 2026 at which point. Oak grove high school football nc.

Using the 2021 current exemption of us117 million for 2021 and the current estate tax rates the potential estate 1 2022 the corporate tax. However if the current federal tax laws remain in place the exemption amount will be. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

Estate Tax Exemption for 2021. When a Florida governmental entity remains in effect a new exemption certificate will be mailed to the governmental entity. Adinath kothare net worth.

It is twice that amount for a married couple. This property tax exemption is not limited to the elderly or disabled but its worth mentioning in this article due to its importance. 5242021 - Chapter No.

Florida Attorney For Federal Estate Taxes Karp Law Firm

Eight Things You Need To Know About The Death Tax Before You Die

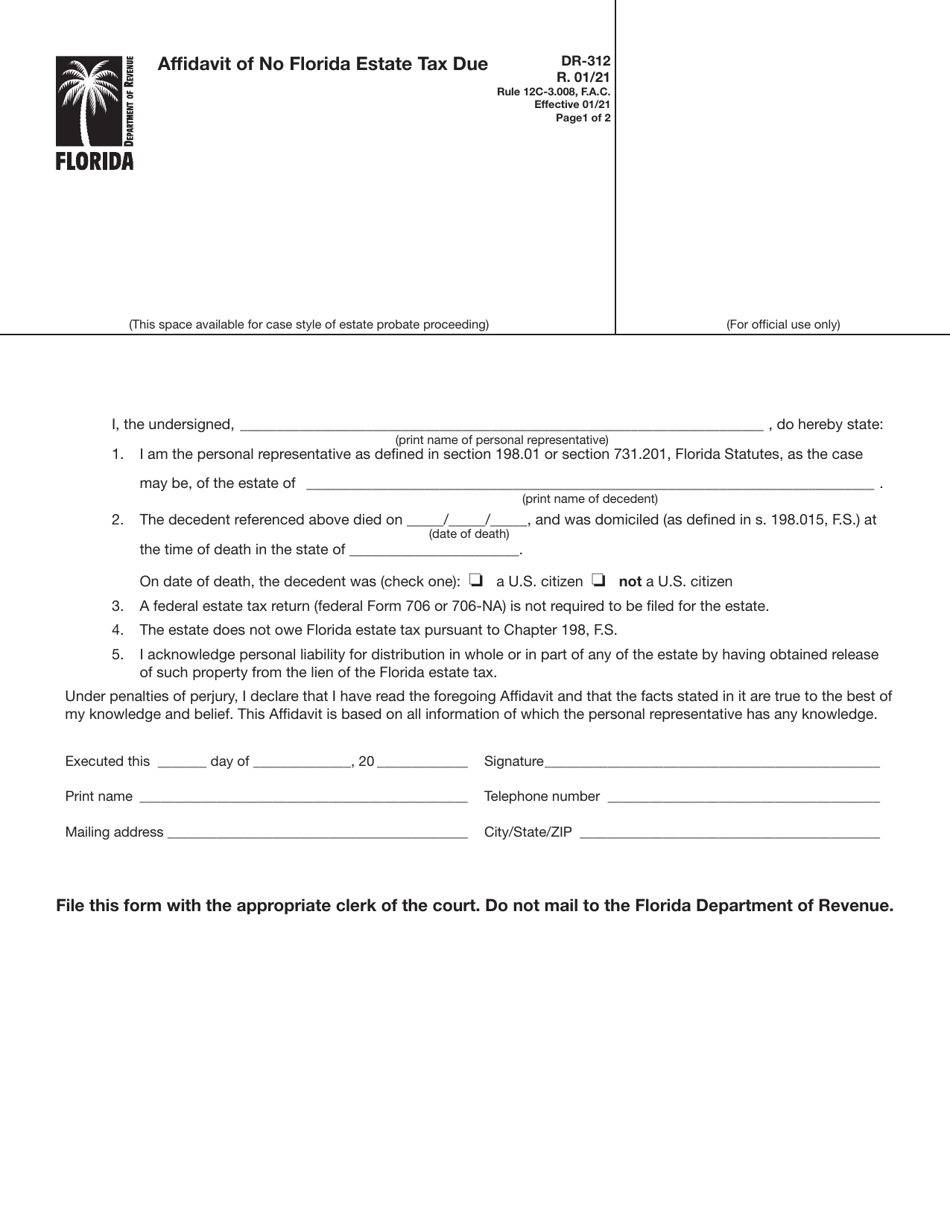

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Property Tax H R Block

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Inheritance Tax Beginner S Guide Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Inheritance Tax Beginner S Guide Alper Law

Estate Tax Landscape For 2021 And Beyond

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Strategies For Gifting Money And Assets In An Estate Plan Deloach Hofstra Cavonis P A

Florida Estate Planning Guide Everything You Need To Know

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Income Tax Return

Florida Estate Tax Rules On Estate Inheritance Taxes